The Dormant Assets Act 2022 (the Act) expands the scope of the Dormant Assets Scheme to include investment and client money assets. Organisations that are headquartered in, or have an entity in the UK, and have the required regulatory permission, are eligible to join the Scheme.

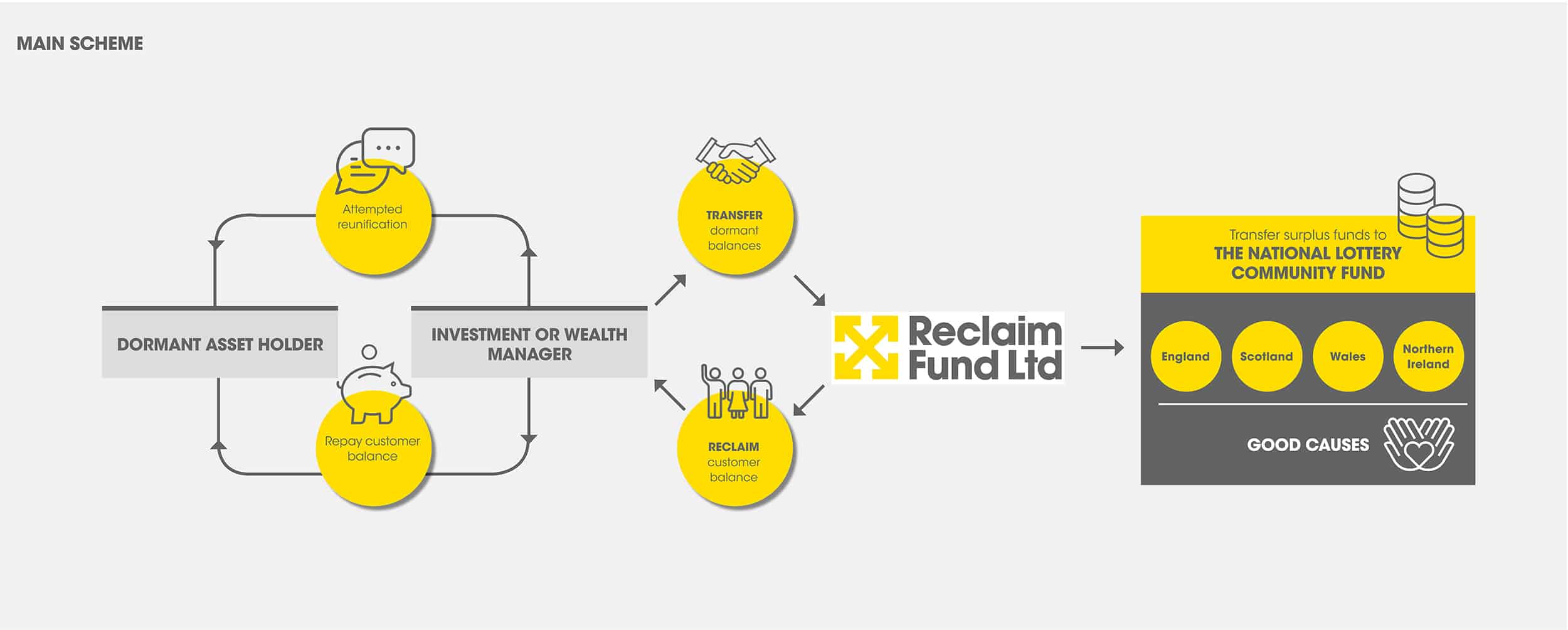

The Scheme enables participating organisations (‘participants’) to transfer monies from eligible dormant assets that cannot be reunited with their owners to RFL. RFL protects the right of asset holders to reclaim the value of their assets at any time in the future. RFL invests funds it receives from participants to cover future reclaims and transfers the surplus to The National Lottery Community Fund which distributes these amounts to good causes across the UK.

Why join?Investment and wealth managers are increasingly placing environmental, social and governance (ESG) priorities at the heart of their strategies. Participating in the Dormant Assets Scheme benefits participants, their customers and the wider communities in which they operate:

Contact us at dormantassets@reclaimfund.co.uk to discuss how your organisation could participate in the Dormant Assets Scheme. |

Assets in scope

Eligible assets in the investment and wealth management sector include collective scheme investments i.e. a share in an authorised open-ended investment company (OEIC), a unit in an authorised unit trust scheme, or a unit in an authorised contractual scheme and client money assets.

The eligible amounts are the converted cash proceeds of a collective scheme investment where, following attempts to trace and reunify the asset with its owner, there has been no contact for at least 12 years. If the amount is a share, unit conversion or is client money, where there has been no contact with the owner for 6 years. Common examples of eligible amounts include:

- Redemption proceeds

- Distributions of income

- Cash held in client money accounts

- Orphan monies

How the Scheme works:

| If you think that you have a lost/unclaimed investment or wealth management product, you should contact the original provider. Alternatively, there are tracing services available who can help (see Useful links on this page). |