The Dormant Assets Act 2022 expanded the scope of the Dormant Assets Scheme to include long-term insurance and pension assets. Organisations that are headquartered in, or have an entity in the UK, and have the required regulatory permission are eligible to join the Scheme. The Scheme is fully open to the sector, with Aviva and Legal & General becoming early participants.

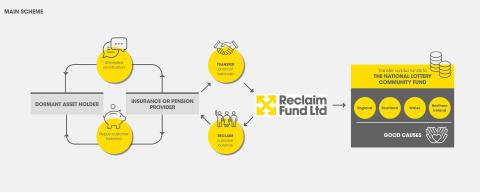

The Scheme enables participating organisations (‘participants’) to transfer monies from eligible dormant assets that cannot be reunited with their owners to RFL.

By doing so, a participant’s liability for customer reclaims is transferred to RFL. RFL (in compliance with the Dormant Bank and Building Society Accounts Act 2008 and the Dormant Assets Act 2022) ensures that the account holders’, or their beneficiaries, right to reclaim their money at any time, is protected in perpetuity. Account holders reclaim their funds from the organisation with which they held an account, which is in turn reimbursed by RFL. RFL transfers surplus funds (i.e. funds that are not required to meet future reclaims) to The National Lottery Community Fund which distributes these amounts to good causes across the UK. Please see Impact of Dormant Assets for more information.

How the Scheme works:

| If you think that you have a lost/unclaimed insurance or pension product, you should contact the original provider. Alternatively, there are tracing services available who can help (see Useful links on this page) |